Securities Financing Transactions

With experience spanning 30 years, Advanced Securities Consulting’s industry recognized experts in the securities financing transactions, including lending and repo, have actively participated in the growth of these sectors into global market forces. Since the early days of the US industry, ASC’s experts have counseled clients in program design, implementation, and assisted them to keep pace with the technological, internal control, and operational advancements and challenges presented by today’s complex multi-national securities lending and repo businesses.

More about Securities Financing Transactions

Expert Testimony and Complex Litigation Support

Financial services, particularly those which rely on securities finance, have become increasingly global, leading to greater technological and transactional complexity. With the explosion of litigation arising out of the 2008 financial crisis, litigants and courts frequently require plain language insight into the structure, flows, and strategies associated with securities finance. Working closely with counsel, our team assists a litigant's analysts and experts to turn archival data into workable records. Then we combine that data with contemporaneous market intelligence. As a result, courts and litigants have meaningful, well supported conclusions that can serve as coherent answers to key litigation issues.

Financial services, particularly those which rely on securities finance, have become increasingly global, leading to greater technological and transactional complexity. With the explosion of litigation arising out of the 2008 financial crisis, litigants and courts frequently require plain language insight into the structure, flows, and strategies associated with securities finance. Working closely with counsel, our team assists a litigant's analysts and experts to turn archival data into workable records. Then we combine that data with contemporaneous market intelligence. As a result, courts and litigants have meaningful, well supported conclusions that can serve as coherent answers to key litigation issues.

More about Expert Witness Testimony and Litigation Support.

Policy and Contract Compliance

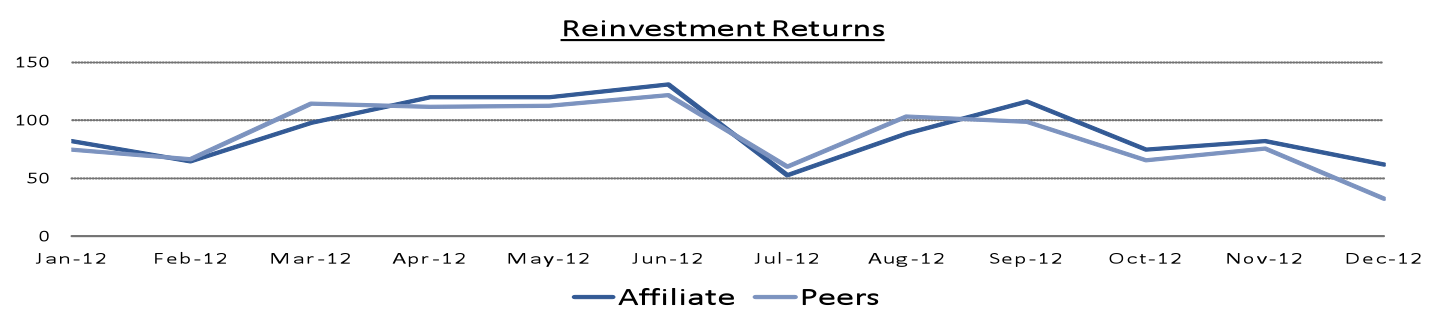

Although cooperating subsidiaries can achieve great service efficiencies, the prospect of regulatory reforms or operational restructuring can create unexpected risks to fiduciary compliance. In such cases, ASC assists the boards of firms in evaluating compliance with program objectives and contract terms.

More about Affiliate Contract Validation

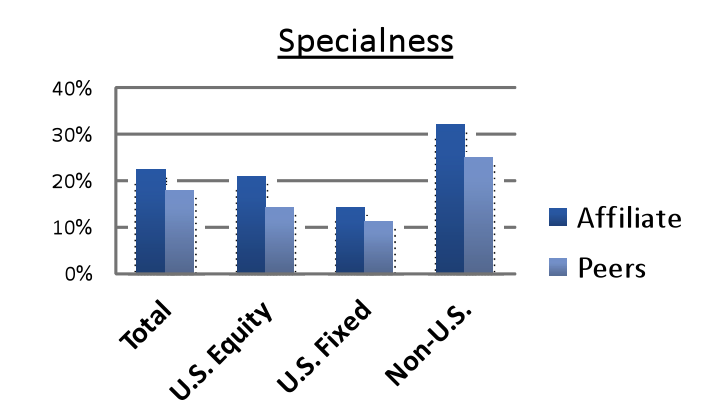

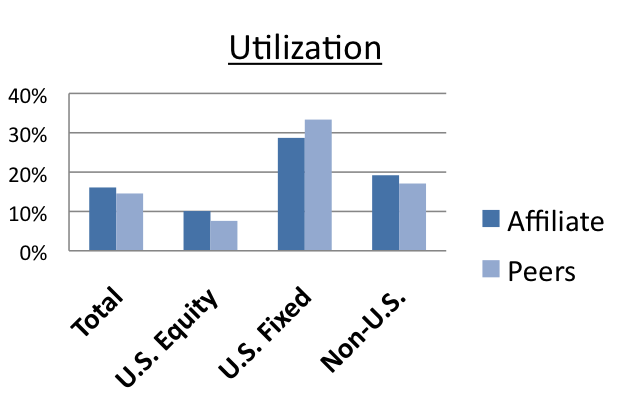

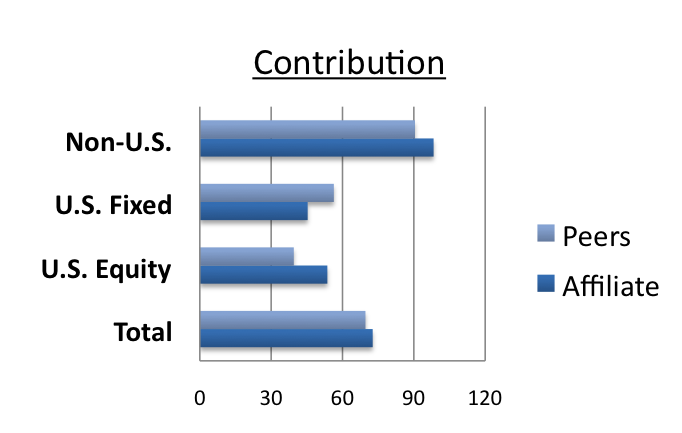

Profitability / Performance Measurement

The key to a successful securities lending program is the effective management of value generation versus risk. ASC assists clients to strike the appropriate balance by providing in-depth performance measurement and assessments of program management.

More about Profitability Analysis and Performance Measurement.

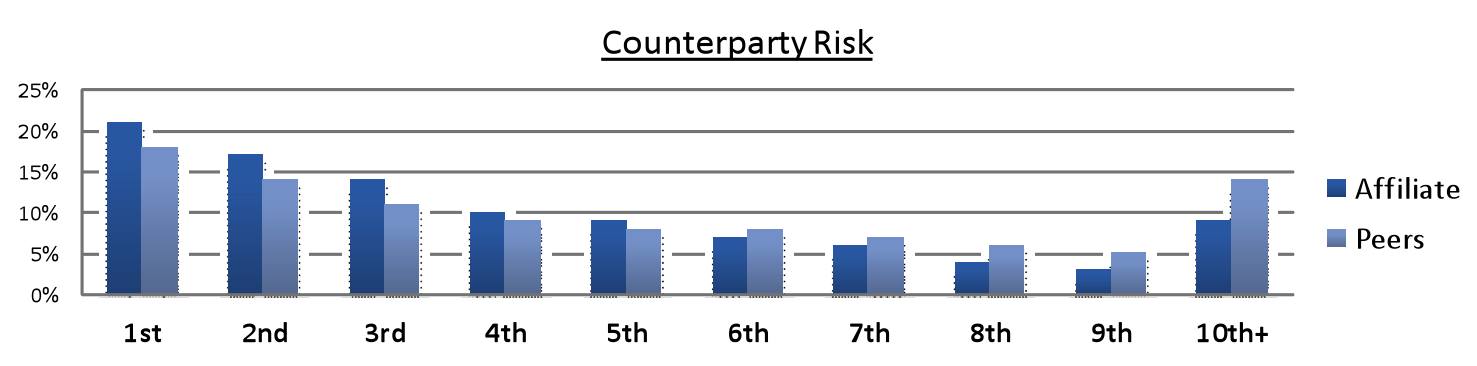

Risk Management

Following the failure of Lehman Brothers, counterparty risk and the risks surrounding the investment of lenders’ collateral became the focus of lenders, borrowers, and agents alike. Advanced Securities Consulting assists clients on all sides of securities lending transactions to better understand and manage the risks associated with securities lending:

Following the failure of Lehman Brothers, counterparty risk and the risks surrounding the investment of lenders’ collateral became the focus of lenders, borrowers, and agents alike. Advanced Securities Consulting assists clients on all sides of securities lending transactions to better understand and manage the risks associated with securities lending:

More about Risk Management.

Corporate Governance

Advanced Securities Consulting advises clients on wide range of corporate governance issues  and matters, including:

and matters, including:

- Proxies/Empty Voting

- Corporate Actions

- Reporting and Disclosure

- Mutual Fund Governance

More about Corporate Governance.

Cash and Collateral Management

ASC works with financial institutions, securities lending agents, hedge funds, broker-dealers, and asset managers to help them streamline and improve their collateral management processes. Whether it be securities lending programs, repo, or OTC or exchange traded derivatives, ASC can help firms develop collateral processes and strategies that control funding costs and effectively manage counterparty and other risks.

ASC works with financial institutions, securities lending agents, hedge funds, broker-dealers, and asset managers to help them streamline and improve their collateral management processes. Whether it be securities lending programs, repo, or OTC or exchange traded derivatives, ASC can help firms develop collateral processes and strategies that control funding costs and effectively manage counterparty and other risks.

More about Cash and Collateral Management.

Capital Markets

Advanced Securities Consulting advises clients on a range of complex instruments and global

transactions. Our consultants assist clients in areas such as:

- Global Custody

- Cash Management

- Structured Products/Derivatives

- ADRs

More about Capital Markets.