Advanced Securities Consulting

ASC is a premier consulting firm specializing in analyzing complex financial transactions. Founded in 2006 by industry veteran Edmon (Ed) Blount, ASC leverages over three decades of securities market experience to deliver unparalleled insights and support to clients.

ASC is a premier consulting firm specializing in analyzing complex financial transactions. Founded in 2006 by industry veteran Edmon (Ed) Blount, ASC leverages over three decades of securities market experience to deliver unparalleled insights and support to clients.

Our team combines deep practical knowledge in securities lending, finance, corporate governance, and risk management with advanced financial, statistical, and quantitative analysis. This unique approach allows us to uncover critical insights from raw data, providing clients with a comprehensive understanding of their financial landscape.

Our mission is to provide clients with rigorous analysis of financial transactions, expert assessments, and forensic data analysis, empowering them to make informed decisions in complex securities markets.

Advanced Securities Consulting provides institutional investors with holistic analysis and expert recommendations on all aspects of securities lending.

Our experts employ both a qualitative and quantitative approach to contract assessment, performance evaluation, and expert witness testimony, backing up conclusions with statistical and other analyses of relevant market or transaction data.

About

Our Experts

ASC’s consultants draw on many years of wide ranging experience in the banking, finance, and securities industries in areas such as securities finance, corporate trust, contract compliance, risk management, corporate governance, and sophisticated quantitative analysis of market data. Our team-based approach means that we can provide the full range of our expertise and experience to every engagement.

Our Services

ASC offers the courts and boards of directors a wide range of financial consulting services, including expert testimony, contract assessment and evaluation, and data mining and coordinate analysis. Our team draws on experience in finance and government, to bring each engagement the benefits of a multi-disciplined approach. We collaborate with lawyers, economists, regulators, and academics to develop defensible, cost-efficient solutions to challenging problems in the capital markets.

Our Outreach

ASC partners with educational organizations to assist in increasing financial literacy. The Regulatory Outreach for Student Education (ROSE) program engages students in the debate over financial services reform. The program is designed to put students in touch with the regulators, policy-makers, and industry leaders who are currently shaping the financial regulatory landscape. ASC challenges students to participate in discussions shaping the financial market.

Expertise Services

Securities Financing Transactions

Expert Testimony and Complex Litigation Support

Policy and Contract Compliance

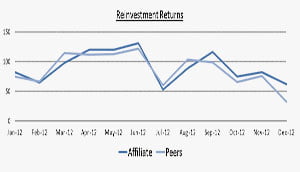

Profitability / Performance Measurement

More about Profitability Analysis and Performance Measurement…

Risk Management

Corporate Governance

Advanced Securities Consulting advises clients on wide range of corporate governance issues Corporate Governance and matters, including:

- Proxies/Empty Voting

- Corporate Actions

- Reporting and Disclosure

- Mutual Fund Governance

Cash and Collateral Management

Capital Markets

- Global Custody

- Cash Management

- Structured Products/Derivatives

- ADRs

Latest News

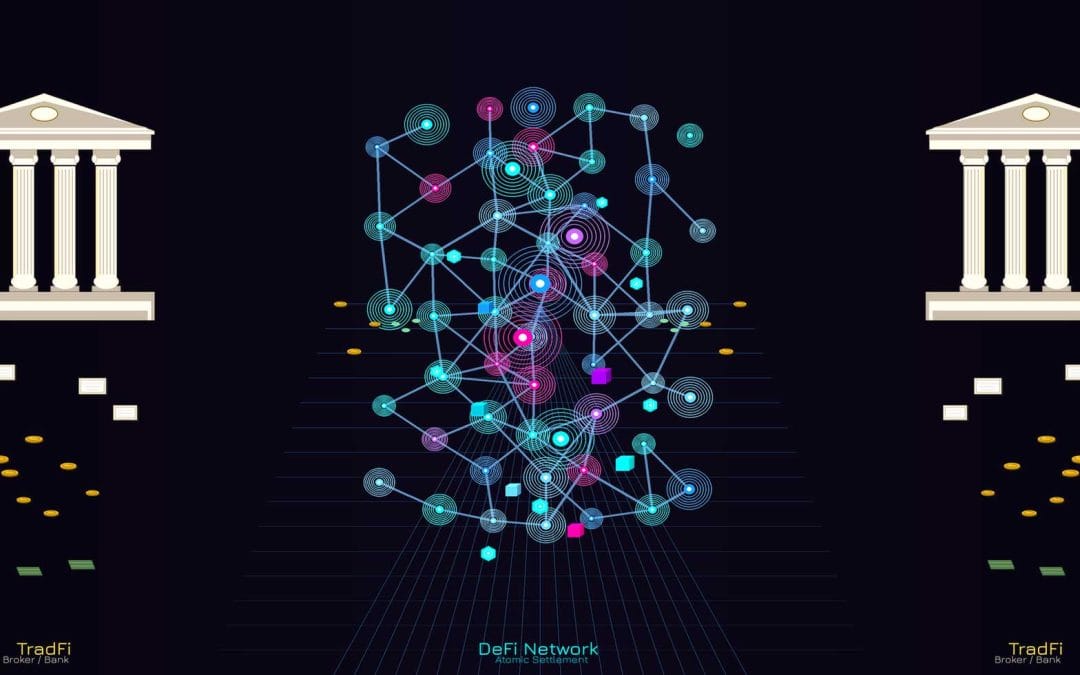

Solving DeFi’s Capital Problem: A Securities Lending Bridge for Prime Money Market Funds

DeFi can’t scale real-world assets without institutional balance sheets behind it—and today’s stablecoin lending pools are too small. This paper outlines a compliant bridge: a fully paid securities lending structure that brings prime money market fund (MMF) cash into securities…

Cash Deal: Money, Markets and Privacy

A friend calls you late on a Tuesday afternoon with the kind of tip that normally circulates only in quiet, well-connected corners of the financial world

Solving the SLR Problem: A Capital-Light Structure for Fully Paid Lending

Recap: The Capital-Intensity Problem In our previous post, we identified the critical challenge threatening the viability of Fully Paid Lending (FPL) programs: capital cost. While compliant with FINRA and SEC rules, a program collateralized with cash creates a massive balance…

Navigating the FPL Paradox: When Compliance Creates a Capital Crisis

Recap: The Foundation of FINRA Rule 4330 In our first post, we explored the essential, customer-facing compliance duties for Fully-Paid Securities Lending (FPL) programs mandated by FINRA Rule 4330. This rule establishes the bedrock of the client relationship. We learned…

Designing the Explainable Lending Desk: Requirements for a Tiered Forecasting and AI Scorecarding Platform

The securities lending industry is at a crossroads, facing dual pressures from regulatory demands for transparency and the market’s push for economic optimization. To gain a competitive edge in this challenging environment, major financial institutions are turning to advanced technology.…

Lily-Pad Thinking

EB: I’m watching a YouTube video on Python:The Documentary | An Origin Story. I have some questions That sounds like a fascinating documentary! Python has such an interesting origin story, from Guido van Rossum’s work at CWI in the Netherlands…

Navigating FINRA Rule 4330: A Broker’s Guide to Fully Paid Securities Lending Programs

Navigating the regulatory landscape of fully-paid securities lending (FPL) programs requires broker-dealers to adhere to a framework of rules centered on customer protection and transparency. These programs offer retail investors a way to generate extra income by lending their securities,…

When AI Meets Wall Street Expertise: Accelerating Innovation in Securities Finance

The intersection of artificial intelligence and domain expertise is creating unprecedented acceleration in financial technology development. A recent securities finance initiative at Advanced Securities Consulting (ASC) exemplifies this transformation, showing how AI-assisted coding can compress months of traditional development into…

Navigating Transparency: AI Analytics and Compliance in Securities Lending

The securities lending market is entering a transformative phase driven by FINRA’s forthcoming SLATE transparency initiative, launching January 2, 2026. This initiative represents a critical pivot from traditionally opaque practices to unprecedented public visibility, reshaping operational standards for securities lending…

From Shadows to Signals: AI and Transparency in Securities Lending Risks

The securities lending market is about to enter a radically transformative phase. Starting January 2, 2026, SEC Rule 10c-1a will mandate daily public reporting of all U.S. securities loan transactions via FINRA’s Securities Lending and Transparency Engine (SLATE). This regulatory…