Policy and Contract Compliance

Lending arrangements involving affiliates are subject to close regulation and scrutiny. ASC examines both qualitative and quantitative aspects of contractual arrangements with affiliates throughout the securities lending transaction chain to help establish a track record of compliance and demonstrate the bona fides of arms length transactions. ASC can also assist firms in structuring securities lending activities with affiliates to maximize compliance and operational efficiency.

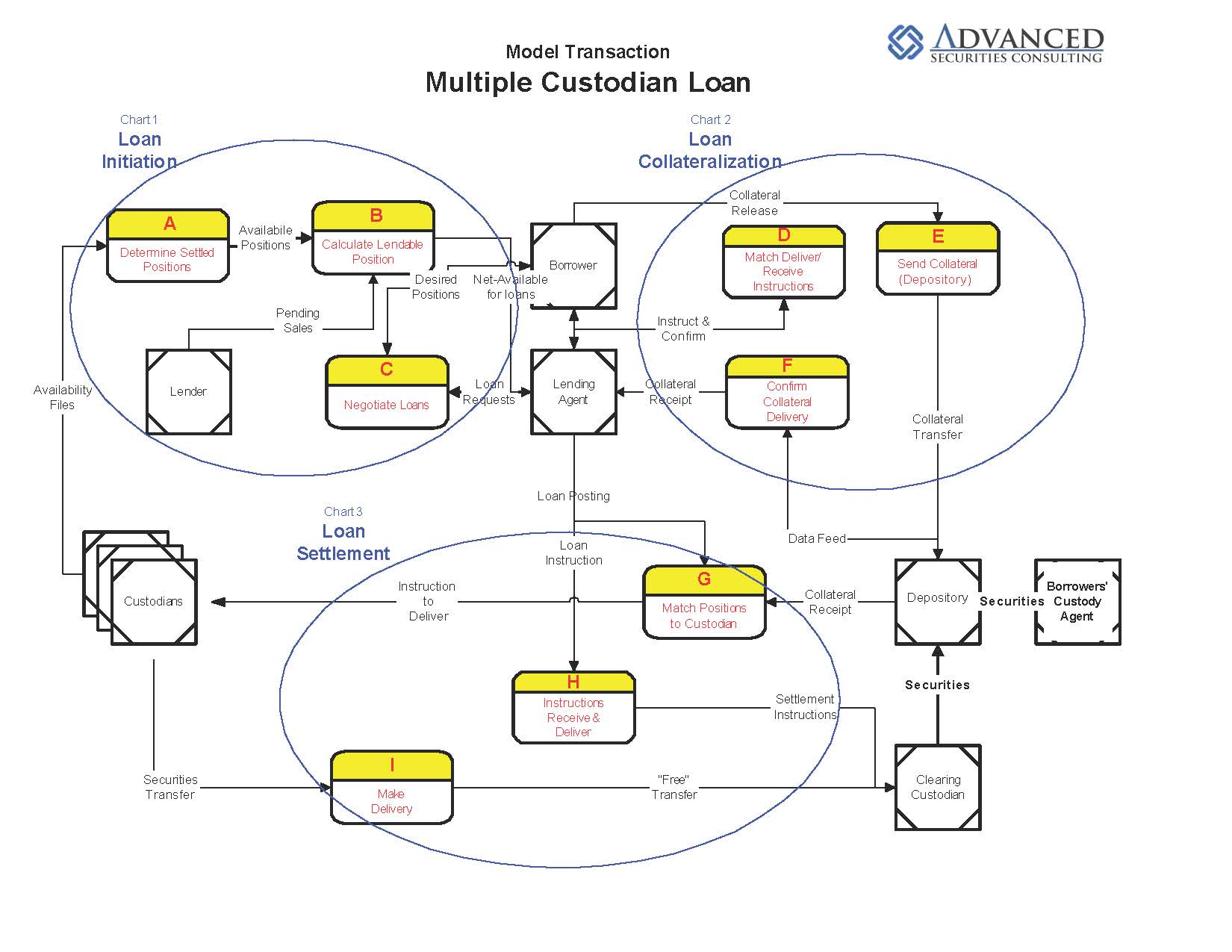

Boards of entities engaging in securities lending are expected to have a strong understanding of how the market for securities lending works, in particular the mechanics of loans, the manner in which the collateral for loans is handled and how securities are recalled an loans unwound. These responsibilities are heightened further when boards oversee securities lending arrangements with affiliates. ASC is able to condense and simplify these technical and complicated concepts and conclusions in language accessible to well-informed, but otherwise engaged professionals on boards at financial institutions.

Confidential Reviews of Affiliate Lending Programs

ASC works with clients to evaluate the prevailing nature of affiliated securities lending programs to help trustees, management and counsel better understand their exposures with respect to compliance with regulatory and fiduciary obligations. Our independent reviews of program fees, risk-adjusted performance, and adequacy of contracts and guidelines for affiliated programs can produce confidential opinions and/or litigation-quality reports recommending improvements in risk management and quality control. For example, in one engagement, ASC was retained by counsel to a fund's board of directors to create holistic evaluation metrics to demonstrate and support the validity of of $350 million in investments through an affiliated securities lending program.

These reviews are also useful to in-house counsel and independent trustees in their ongoing oversight of affiliated lending programs.

Qualitative Analyses

A lender who engages an affilated lending agent in most cases does not have the benefit of an RFP process to validate and support their board's selection of an affiliate. As needed by the client, ASC prepares RFP- and peer-competitive analyses of qualitative exposures for trustees. These "virtual RFPs" extend beyond the limits of traditional metrics to include reviews of:

- Current litigation;

- Prevailing oversight practices;

- Regulatory filings and Board disclosures;

- Fairness and equitability in loan distribution;

- Indemnity vs borrower default and other program losses;

- Cash management/reinvestment risk tolerances;

- Efficiency of pooled collateral management controls;

- Compliance with fiduciary obligations in corporate actions;

- Headline and tax risks in swaps and special arrangements;

- Adequacy of oversight materials, compliance reviews, etc.

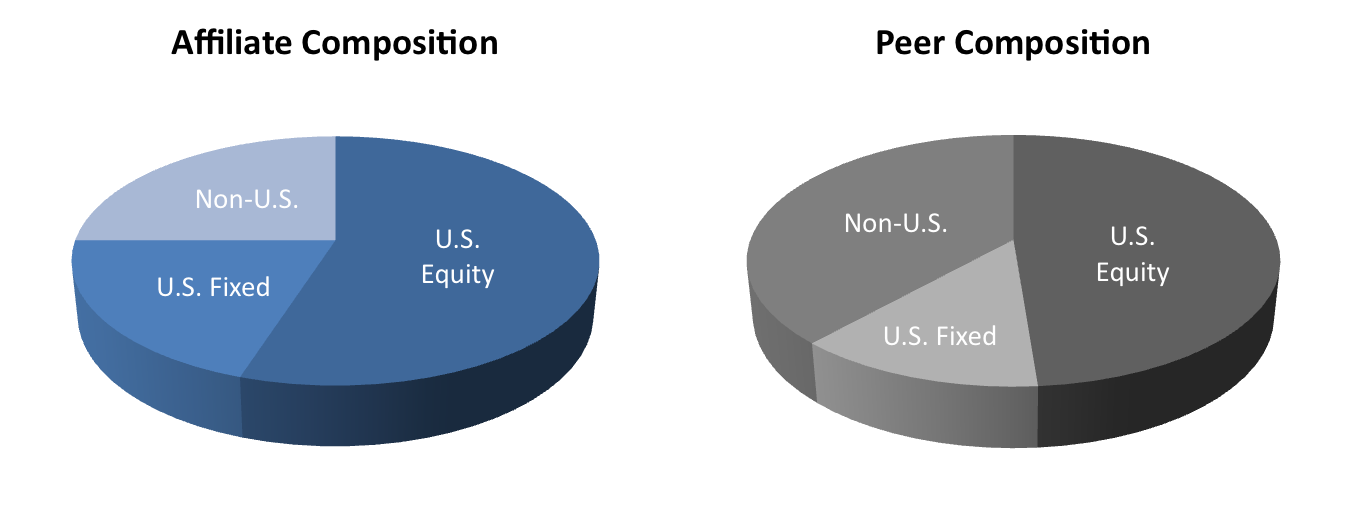

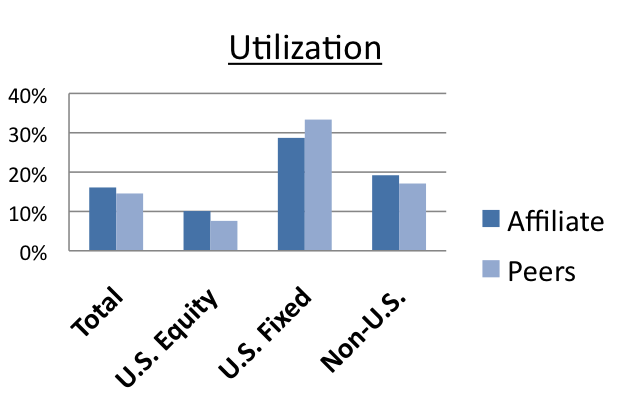

Quantitative Analyses

As required by the client, ASC examines the quantitative exposures for trustees, based upon reviews of:

- Earnings trends and contribution to participant portfolios;

- Revenue splits vs industry/affiliated program standards;

- Portfolio size, availability, turnover, and utilization;

- Loan rebates, tenures, fees and cash reinvestment earnings;

- Cash reinvestment pool composition and other characteristics;

- ForEx spreads, fees, and benchmarks in cross-border cash management;

- Economic substance for yield enhancement counterparties;

- Fault-tree isolation of market, credit, counterparty and operational risk factors;

- Related program and industry metrics, as required and available. (See Profitability and Performance Measurement)