Data engineering by Dan Hammond

When, on October 13, 2023, the Securities and Exchange Commission released its long-awaited final 10c-1 rule on reporting and public disclosure of securities loans (explained here), the most important passage, at least to the commercial data vendors who support the securities finance community, stated that, “the final rule could render existing securities lending data services less valuable, potentially leading to less revenue for the firms currently compiling and distributing these data for a fee.”[1] But is that true? Are bonuses and careers really at risk?? As shown in the table below, there is hope for vendors because the public data release will either omit or delay several data elements that are crucial to many important vendor applications today.

Table 1 Data Elements available to securities finance analysts, now and as mandated.

Notes: New rule 10c-1 requires daily submission of confidential loan data to the SEC, as well as partial fail data if shares are borrowed to avoid Reg SHO buy-ins. Public data disclosures will be available from FINRA no later than next morning (X) after each loan is effected or delayed 20 days (Y). For vendor availability, please refer to data dictionaries and subscriber restrictions.

Modern benchmarking of performance as a securities lender requires comparison to the results of similar funds that, since neither lenders nor borrowers will be disclosed to the public, will be impossible with public data alone. Benchmarking vendors today use fund type codes from service providers to create peer reviews. Without adjustments for the lender’s portfolio composition or investment style, it will not be possible to group similar lenders. However, the vendor advantage may be short lived if large competitors can use public data to extrapolate or validate their B2B datasets. Lending agents who are now benchmarking customers of vendors may elect to use the tens of millions of loan data records and modifications that will be released each month as a resource to train their own generative AI models to predict borrower demand and fees, inventory fails and other key performance metrics.

Accurate market sizing will enable database engineers to calibrate the statistical significance of smaller sample sizes when publishing benchmarks or indexes. As the SEC pointed out, the public market data will raise the competitive bar by enabling new  services[2] to complement opportunities in advanced analytics.[3] Fintechs will see product opportunities in the more than one million records submitted daily from service providers on behalf of market participants.

services[2] to complement opportunities in advanced analytics.[3] Fintechs will see product opportunities in the more than one million records submitted daily from service providers on behalf of market participants.

We can use a well-known episode in recent market history to illustrate how public and vendor securities lending data can be combined to better understand how securities finance imposes credit constraints that limit the excesses in trading markets. In March 2021, Archegos, a family office with experienced hedge fund managers and a multi-billion dollar portfolio, leveraged single name swaps to rig the market for CBS Viacom (VIAC) shares and a dozen other issues (read more here).

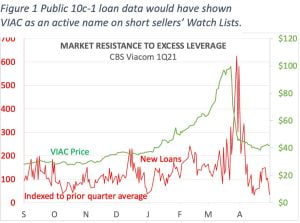

As shown in Figure 1, a simple comparison of new loans to the stock price would have revealed the activity of short sellers to the Archegos pump-and-dump scheme. New loan data will be available in the 10c-1 release. However, vendor data would be needed to advance the analytics. With enrichment of public datasets by benchmarkers, e.g., by adding aggregate loan size, tenure of returns, and units outstanding, even the most basic GenAI models could have estimated the unrealized gains/losses of strategic short sellers, as their models reacted to the leverage of Archegos. More advanced GenAI models, enriched by details at the trade ticket level, could also have generated recommendations for inventory buffers and smart recalls to comply with voting stewardship reports.

Trading Analytics at the Next Level

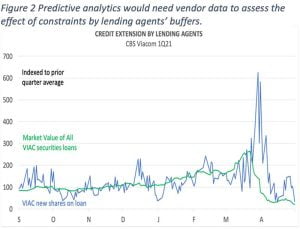

Outstanding units on loan is one of the simplest and still best indicators of market leverage.[4] As shown in Figures 2 and 3, conditions in the securities funding market for VIAC shares during the Archegos manipulation were much tighter than in the prior quarter.

These are useful values in predictive analytics but only available to vendors’ customers. As used in Figure 3, the aging of returned loans can be used to infer the strategies being followed by borrowers. (For example, long term loans being returned implies the buy-in of short positions by directional hedge funds.) If borrowers can be analyzed as a basket of loans, then any change in that basket’s aging can signal a shift in dominant style, both for markets and individual counterparties.

These are useful values in predictive analytics but only available to vendors’ customers. As used in Figure 3, the aging of returned loans can be used to infer the strategies being followed by borrowers. (For example, long term loans being returned implies the buy-in of short positions by directional hedge funds.) If borrowers can be analyzed as a basket of loans, then any change in that basket’s aging can signal a shift in dominant style, both for markets and individual counterparties.

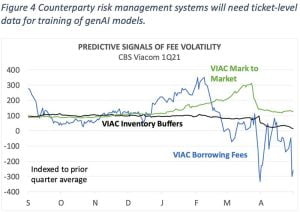

Product managers at fintechs will use the public data reports to create the Market Posse chart shown in Figure 4, which shows the inflection point at which the bubble was burst by tactical short sellers. Transaction-level data is needed for semi-supervised learning in generative ai, starting with peer clustering. Models of risk tolerances, preferences, and other factors can be used to create a world within the real world. However, the total of loaned volume in each synthetic model must be constrained to the disclosed metrics. Within those limits, dispersion models of synthetic borrowers can be generated with risk profiles for a large number of security baskets. Securities lenders could then match the risk profiles of their actual borrowers to the synthetic profiles on a real-time basis.

A more advanced data set can be used to train loan risk classification models for use by an enabling platform to predict and avoid stock loan defaults by borrowers. Pooled ticket level data from the beneficial  owners of a data trust can provide that more granular dataset to improve their ability to optimize lendable portfolio inventories. (Read more here.)

owners of a data trust can provide that more granular dataset to improve their ability to optimize lendable portfolio inventories. (Read more here.)

Counterparties approaching their risk tolerance limits can be prioritized by lending agents as targets for smart recalls. GenAI models with an enabling platform can trim, at the very least, their lenders’ marginal periods of risk and potential exposure at default. That can spell major savings in economic capital charges.

New Opportunities for Data Vendors

Through a variety of methods, lending agents monitor those of their counterparties who most closely fit the riskiest profiles they see on the market surface. By embedding that expertise in genAI models, synthetic counterparties can be created for lending agents from enriched loan data to train deep learning models. Agents will want the most reliable datasets for training their distribution queues and prime brokers will want vendors to enrich their dynamic margining algorithms for selected asset classes or issues. These are quite literally golden opportunities for vendors.

The best data products will help to reduce the costs of fails after the T+1 settlement upgrade in the U.S. and may argue for lowering the higher risk-weighted asset (RWA) capital charges for borrower default indemnification under Basel III+. Lending agents for U. S. mutual funds will offer analytics that predict fails and avoid N-PX penalties. The most successful vendors will offer upgraded analytic platforms, such as FISʼ Lending Pit, that can turn raw data into the parameters needed by generativeAI models. Shared ledgers will use plug-in APIs to mix the predictive analytics with their customersʼ own risk management platforms.

The best data products will help to reduce the costs of fails after the T+1 settlement upgrade in the U.S. and may argue for lowering the higher risk-weighted asset (RWA) capital charges for borrower default indemnification under Basel III+. Lending agents for U. S. mutual funds will offer analytics that predict fails and avoid N-PX penalties. The most successful vendors will offer upgraded analytic platforms, such as FISʼ Lending Pit, that can turn raw data into the parameters needed by generativeAI models. Shared ledgers will use plug-in APIs to mix the predictive analytics with their customersʼ own risk management platforms.

Predictive analytics based on enriched loan filings can help with dynamic management of buffers in a straight through processing environment to minimize settlement delays. Costly inventory fails-to- deliver and CSDR-like penalties from their global custodians are not the only costs; fails may also be leading indicators of default for overleveraged counterparties, such as in the Archegos scheme.

[1] Securities and Exchange Commission, Release No. 34-98737; File No. S7-18-21, page 178

[2] “The use of third-party vendors by covered persons could enable the innovation and development of novel reporting services, such as the data trusts described by one commenter. See Advanced Securities Consulting Letter.” Ibid, footnote 190, page 45

[3] “The Commission believes that a potential mitigating factor that may reduce or even offset the severity of this loss in revenue will be that commercial data vendors may offset some of the impact of lowered demand for their data by enhancing their related data analytics businesses using Rule 10c-1a data.” Ibid, page 275; “To the extent that customers value the availability of information about securities available to lend and utilization rates, the fact that commercial data vendors will continue to have superior access to this information will likely mitigate or even offset a decrease in demand, as investors would continue to purchase commercial datasets in order to gain access to this information.”

[4] In the final rule, the proposed obligation to report outstanding and available loan position data was eliminated. In effect, the SEC carved out a base upon which data vendors might advance their business models with a mix of existing and enriched datasets.